Updated on January 21st, 2025.

We’re thrilled to announce the release of Appodeal Benchmarks, a powerful, free-to-use tool for anyone in the mobile gaming and ad tech industry!

As with the old eCPM Report, we will update the data on our new tool, Appodeal Benchmarks, every quarter. But this time, we will not just give you eCPMs but also retention data, ad impressions, and much more data, based on millions of ad impressions worldwide from 80+ Ad Networks.

With Appodeal Benchmarks, we’re giving mobile app developers, publishers, and marketers the tools they need to fully understand their monetization potential across multiple dimensions — on-demand and free.

Optimize your Ad Monetization Strategy, find new audiences, and learn new ways to increase your revenues.

Try out Appodeal Benchmarks today and take the guesswork out of monetization!

Summary:

eCPM Reports on Demand!

While many companies are moving towards more closed-off ecosystems, we at Appodeal take the opposite approach. Transparency and data accessibility are at the core of our mission—to help app creators scale and grow their businesses with clear, actionable insights.

This marks a significant step forward in providing transparency and accessibility in an industry that often feels like a black box.

With Appodeal Benchmarks, you can dive deep into the mobile ad industry like never before. You’ll have access to key monetization and retention metrics—such as eCPMs, Impressions per User, and Daily Retention Rates—all broken down by app category, country, platform, and more, giving you a comprehensive understanding of your app’s performance in a matter of clicks.

How to use Appodeal Benchmarks?

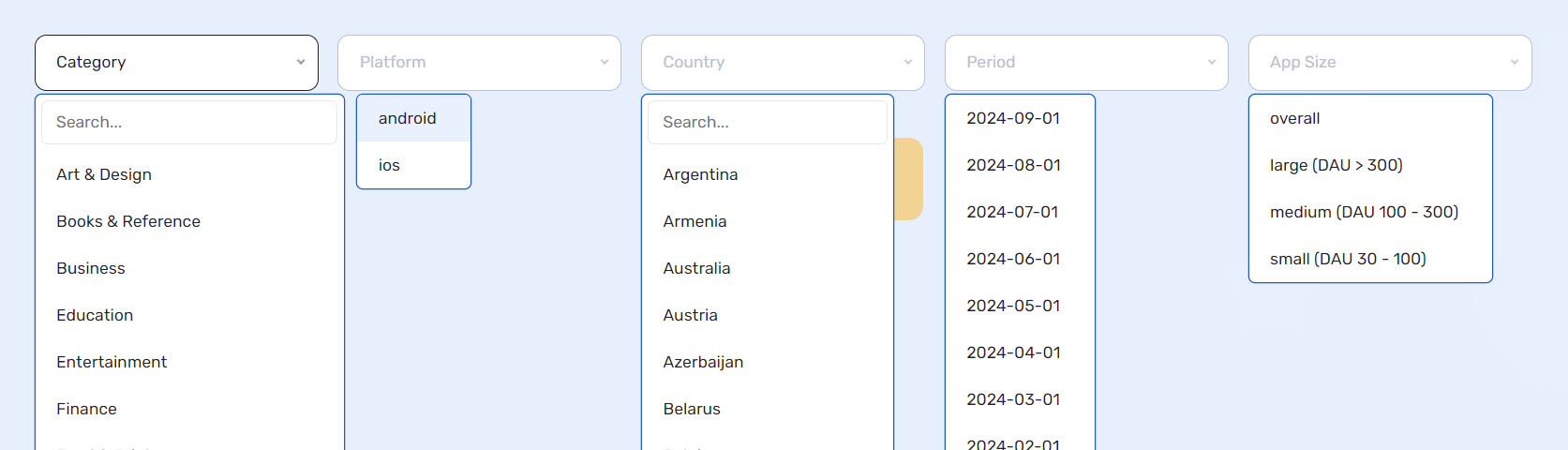

It’s simple. Our tool features five filters:

- App Category: Choose from the categories available on major app stores.

- Mobile Platform: Select iOS or Android.

- Country: Filter data by specific countries where we have robust data sets.

- Period: Pick the month for which you want to view data.

- App Size: Filter by app size to compare with apps that match your user base—whether your app has a few million installs or hundreds of millions.

Once these are set, you’ll receive detailed and highly accurate metrics tailored to your needs.

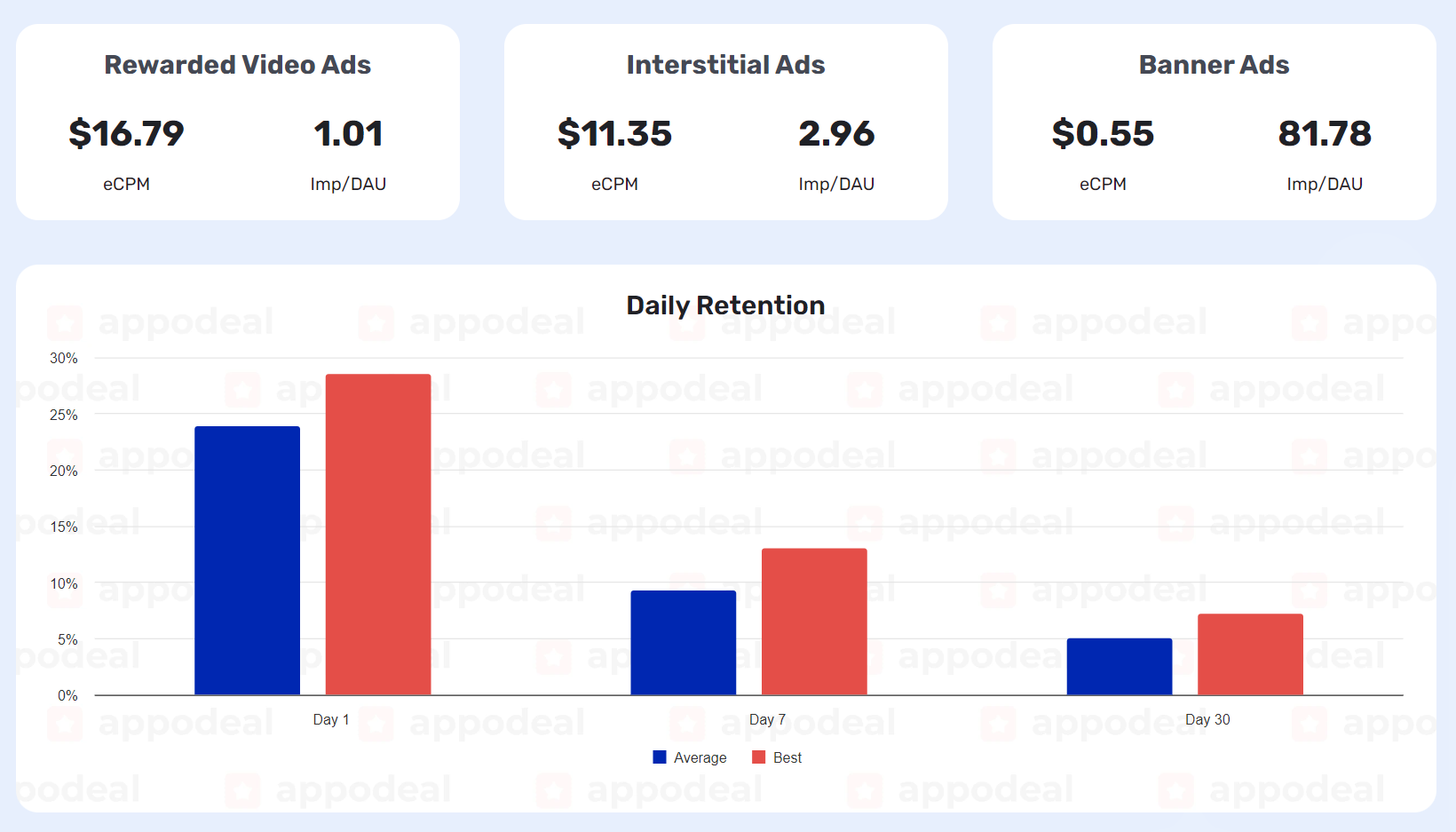

Right now, Appodeal Benchmarks offers insights into the three most important metrics we’ve identified:

- eCPMs (Effective Cost per Mille): The revenue generated per 1,000 ad impressions.

- Impressions per User: The number of ad impressions served per user in a given period.

- Daily Retention Rates: How well your app retains users over time.

We’ve chosen these metrics based on their relevance to monetization and retention strategies, but we’re just getting started.

More metrics will be added soon, and we’d love to hear your suggestions!

Feel free to contact me on LinkedIn if there’s a specific metric you’d like to see in the Appodeal Benchmarks!

Why Appodeal Benchmarks? A Natural Evolution

When I joined Appodeal in early 2020, I launched the Mobile eCPM Report, which provided quarterly insights into eCPMs across the top 3 mobile ad formats: banners, interstitials, and rewarded videos.

What started with just five countries quickly grew to nearly 20, offering developers key information on monetization performance worldwide.

Building on that foundation, we also released the Mobile Performance Index Report annually, which added new dimensions like ARPU (Average Revenue per User), impressions, and retention data. These reports were well-received, but we knew we could take it further.

Appodeal Benchmarks is a natural evolution of all those reports. A tool that goes beyond eCPMs and brings more monetization metrics, such as data impressions and even retention metrics! We have also expanded the list of countries from 20 to over 120!

This was a well-deserved update in an industry that is ever-changing and forever challenging.

Finally, get instant access to top-quality data without digging through lengthy reports!

What’s Next for Appodeal Benchmarks?

We’re committed to keeping Appodeal Benchmarks as fresh and relevant as possible. We're working to update the data once every quarter, just like our original Mobile eCPM Reports. We’re also working on several new features, including:

- Regional & Tier Filters: We’re expanding country filters to include regions like West Europe, East Europe, EMEA, Asia, etc., as well as classifications by Tier-1, Tier-2, and Tier-3 markets.

- Quarterly Periods: Besides monthly metrics, you’ll soon be able to view data over broader periods.

- Trend Charts: Similar to the Mobile eCPM Report, we want to display the evolution of key metrics over time with charts showing month-by-month data.

About the Data Source

It’s one thing to talk about transparency, but with Appodeal Benchmarks, we’re showing it. The data in this tool is drawn from billions of anonymized ad impressions we serve across our network.

Unlike other benchmarking tools in the industry, the Appodeal Benchmarks breaks down revenue metrics by specific ad formats, offering the most accurate picture possible for each app category and platform.

The Appodeal Benchmarks represent the average eCPMs from billions of ad impressions served during the analyzed period for each country worldwide, where we have significant impression data.

Our algorithm evaluates each ad bid in real time, serving the highest bidder to ensure your app's best possible ad revenue. While many tools offer broad industry averages, we provide detailed, format-specific metrics—something almost no one else in the gaming industry is doing.

We hope mobile app publishers and developers will find the Appodeal Benchmarks useful for their app's ad revenue and for gaining a fuller understanding of earning potential worldwide as their app grows.

About the Old Mobile eCPM Report

tldr; The Old Mobile eCPM Report has been moved to Appodeal Academy in a course format for better accessibility.

For the last five years, I've been building the eCPM Report, a trusted resource for mobile app creators and publishers, delivering critical insights into ad performance trends. It’s guided developers worldwide to make smarter monetization decisions and unlock their app’s revenue potential.

Now, in our mission to provide an even more comprehensive and tailored learning experience, I'm excited to announce that all eCPM Report insights have been moved exclusively to the Appodeal Academy.

Why the Change?

This move allows us to offer more than just static insights. By integrating the eCPM Report data into the Academy, we can provide:

- Interactive Learning: Dive into detailed modules segmented by year, quarter, and ad format to understand eCPM trends in greater depth.

- Actionable Strategies: Each module and lesson includes takeaways designed to help you immediately implement growth-boosting strategies for your apps.

- Better Accessibility: Instead of searching through blog archives, you’ll find the insights structured into an easy-to-navigate curriculum within the Academy.

- Community Support: The Academy is more than just a resource hub—it’s a community of like-minded app creators and industry professionals who are passionate about mobile growth.

How to Access the eCPM Insights

To explore the latest eCPM trends and actionable advice for optimizing your monetization strategies, simply visit the Appodeal Academy. Signing up is quick, and you’ll gain access to exclusive free courses, apart from the eCPM Report Insights, including the full breakdown of global eCPM performance for Rewarded Videos, Interstitials, and Banners.

By consolidating all eCPM insights into the Academy, we aim to empower app creators like never before—offering not just data but the knowledge to interpret and act on it for long-term growth.

Head over to the Academy and unlock the full potential of your app’s monetization strategy today!